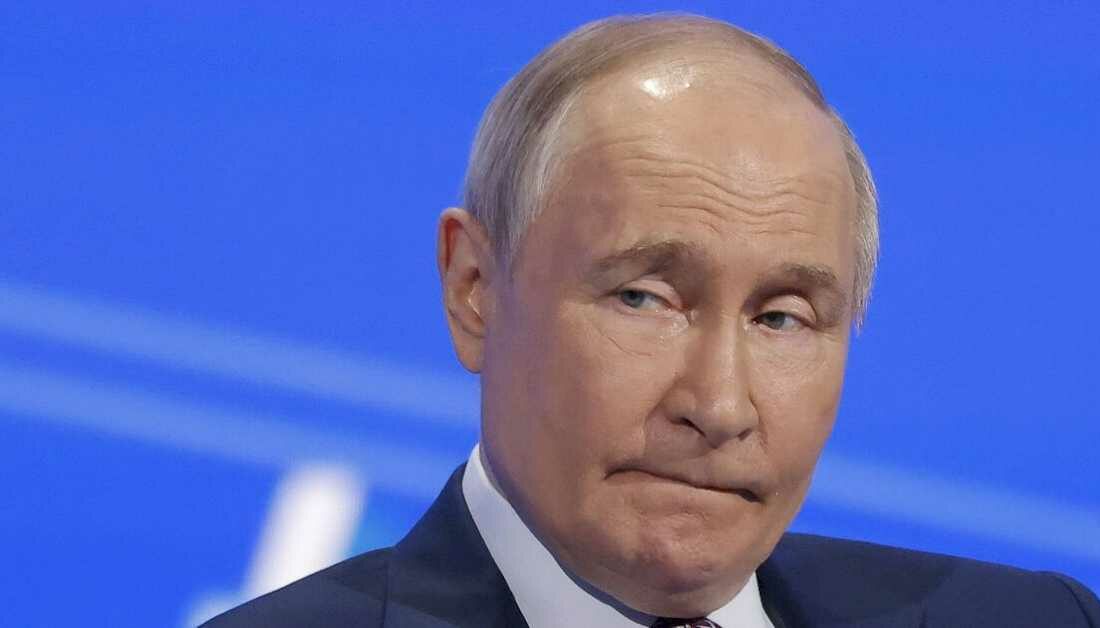

Vladimir Putin is could be attempting to blame the boss of Russia’s central bank for the country’s economic issues as businesspeople criticise wartime economic policies, reports have suggested. The Russian President is trying to suggest that the country’s rising inflation rate is the fault of its Central Bank, and its Chair Elvira Nabiullina, experts at the Institute for the Study of War (ISW) write.

Inflation has been rising because of Putin’s full-scale invasion of Ukraine, which began more than three years ago in Febraury 2022. The Russian Central Bank decided in December 2024 to keep the key interest rate at 21%, the highest it has been since 2003, as part of efforts to mitigate against growing inflation. The rate has remained “relatively conservative” so far in 2025, despite “significant and growing inflationary pressures”. The ISW reported: “The Kremlin has claimed in recent months that the inflation rate is about nine to 10%, but these figures are likely far below the actual inflation rate, which is likely closer to 20 to 25%.

Russia‘s current interest rate should likely be higher, and the Kremlin likely pressured the Central Bank to keep the rate at 21% when the Central Bank should have increased it to curb inflation.”

It comes as a Russian “insider source” claimed last week that the Russian Federation Council Accounts Chamber, the country’s highest audit body, recently began looking into the Russian Central Bank to “investigate its monetary policy from 2022 to 2024 and the impact of the interest rate on inflation, budget expenditures, and investment”.

The ISW added that the source claimed the investigation is “effectively” an attack on Nabiullina.

The insider source also claimed that large Russian businesses are seeking interest rate reductions.

But experts highlighted that they cannot independently verify these claims, and the ISW has not observed other reporting about the alleged audit.

The ISW suggests that Putin blaming Nabiullina is likely an effort to “draw the ire of the Russian business community away from the Kremlin and onto her”.

However, Nabiullina “likely has not been able to exercise fully independent monetary policy”.

Experts added: “The audit on the Central Bank may be part of the Kremlin’s ongoing efforts to apply political pressure on the bank to prevent further interest rate hikes beyond the current rate of 21%, manage the expectations and frustrations of the Russian business community, and further the Kremlin’s narrative about Russia‘s economic stability.

“The Kremlin’s continued manipulation of the Central Bank’s decisions is likely hampering the Russian government’s ability to enact sound wartime monetary policies.”